us500

REPORTS

SENTIMENT

FLOWS

SUMMARY

SETUPS

Frequently Ask Questions

The COT report reveals the positions of market participants as of Tuesday's market close. It breaks down the long and short positions of three key groups of market participants: Commercial, Large Speculators and Small Traders.

The COT report helps traders understand market trends and potential price movements by analyzing the net positions of these groups.

The report is used to make informed trading decisions, but it is not a timing instrument. It indicates potential market changes, requiring further analysis and monitoring.

Frequently Ask Questions

Retail sentiment refers to the data that reveals the positioning of traders, indicating whether they are net long or net short.

The most retail forex traders (unfortunately) lose money.Consider taking positions opposite to the prevailing sentiment. For example, if the majority are long, you might look for opportunities to go short.

The signal is more significant when the value is greater than 70% or less than 30%.

These data show the average prices for traders' open long and short positions, which come from public sources and are highly valuable for your own graphical analysis as they provide a clear indication of trading liquidity levels.

Frequently Ask Questions

Option flows is a highly useful tool for assessing market conditions, but it must be interpreted accurately, which is often not the case. It requires significant practice and a deep understanding of the logic behind option portfolios to extract meaningful sentiment and distinguish it from the typical noise associated with options. insider sentiment, which has a predictive value regarding the future movement of the market, is obtained exactly using data from the options market.

The Chicago Mercantile Exchange (CME), colloquially known as the Chicago Merc, is an organized exchange for the trading of futures and options. The CME is the largest futures and options exchange by daily volume. According to CME Group, the exchange handles 3 billion contracts per year, worth approximately $1 quadrillion

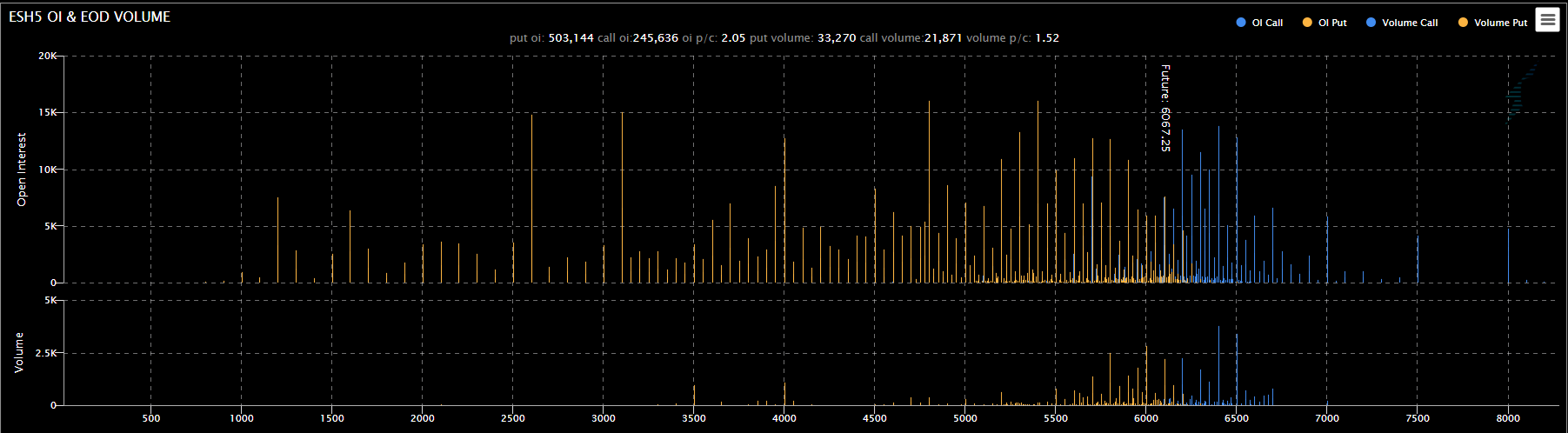

The chart illustrates the variation in open interest (active trades) across different strike prices over the past day. As multiple option series with varying expiration dates are traded simultaneously on the CME exchange, we only display the nearest monthly series for the instrument. Additionally, we transition to a new monthly series five days prior to the expiration of the current one, as all trading activity shifts to the upcoming option series. According to our observations, it is in the monthly and quarterly option series that the activity of both large participants (Smart Money) and insiders is most evident.

Current Strength

Strong

Current Direction

Strongest

Frequently Ask Questions

It provides traders with insights into what various popular trading systems recommend regarding going long or short in the market. This tool analyzes up to several years of historical data, applying different technical indicators (from long to short-term ) to the price data and then performing calculations.

No, the data is updated 4 times a day

Frequently Ask Questions

The setups are based on ANN (Approximate Nearest Neighbors) machine learning, which is a way to quickly find the closest points in a bunch of data.

Financial data often exhibit noise and include outliers because of market fluctuations. The ANN method is better at recognizing significant patterns in this type of data, which enhances prediction accuracy. Additionally, it can uncover intricate patterns in historical data that simpler methods might overlook.

Depending on market conditions, the Win Rate can reach 85%, with a Win/Loss ratio up to 3 to 1. This method performs best during trending movements rather than in sideways markets.

Yes, but we highly recommend utilizing those algorithmic settings alongside other indicators from this platform and in alignment with the prevailing market trend, all while maintaining strong risk management.